Student debt crisis

Students loans are only setting up undergraduates for failure for the future

February 28, 2020

College is expected in most careers for new graduates from high school. High schoolers can take the next step to their education. This requires 18-year-olds to choose a path for their career, which comes with an expensive price. With university, community college and private colleges there are numerous options. However, many students struggle with paying for their education. Which can lead to pulling out student loans, but are these loans safe for the economy for our future?

College is high-priced due to the increase in financial aid and lack of funding. As degrees are required for most jobs, this causes students to have a longer education which will cost more, which can cause more students to fall into debt. Most high paying jobs pay over 35,000 require a bachelor’s degree or higher according to Three Educational Pathway to Good Jobs.

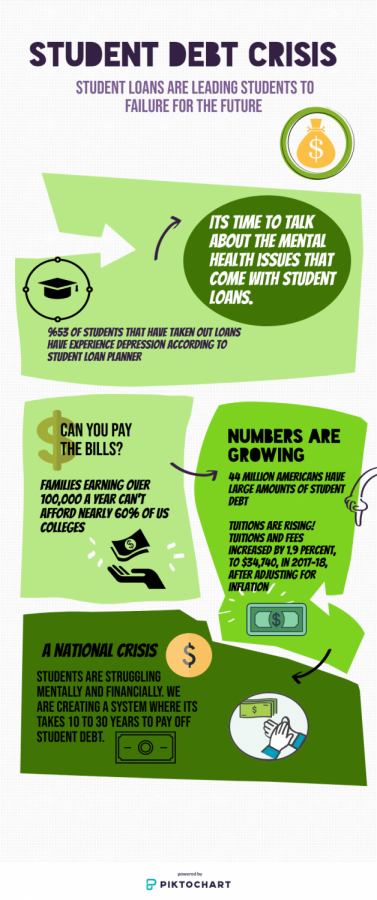

New high school graduates are going to college knowing they will need student loans. According to research by the Institute for Higher Education Policy (IHEP), even families earning over $100,000 a year can’t afford nearly 60% of U.S. colleges. Stated by NASFAA Low-Income Students Cannot Afford 95 % of Colleges. College affordability for families is not a new issue. Over half of families can’t afford college for their kids. We are sending our students to get an education and start adulthood with a large amount of debt.

With students dealing with owing money to their college, this has a bad impact on these learners’ mental health. Due to the debt. 53% of student debt loaners have experienced depression, and nine out of ten have experienced anxiety due to their loan burden. The mental health awareness survey from Student Loan Planner states there have been 11 deaths partly due to student loans. Student loans are leading to more suicidal students. Is this how we want to start our future workers to start adulthood?

According to the Federal Reserve Bank of New York, the student loan debt falls between $902 billion and $1 trillion with around $864 billion in federal student loan debt. It can take up to 10 to 30 years to pay off student loans stated by Natalie Issa, a specialist at credit.com. This is a national crisis that should have more awareness from students and parents.

The national student debt crisis is only growing as tuitions rise. Students are facing mental health issues from taking out loans for college. We are setting up our students for failure by creating a system where it takes 10 to 30 years to pay off student debt. It’s a rigged system where younger adults fall and don’t know how to get out. This situation should be more national recognition for future workers and the United States economy.

Students can reduce college debt in many ways. There are sources where students can reach out to about debt. Find free sources of money that will help to pay for undergraduates, such as grants and scholarships. Free Application for Federal Student Aid (FAFSA®) is a good source to find scholarships and grants for college students. Start saving today a dollar put away is a dollar you don’t owe. Most college students work part-time for food, transportation, rooming and textbooks. It helps to look at in-state colleges and find colleges that have “no loans” financial aid policies to minimizing student debt due to loans.